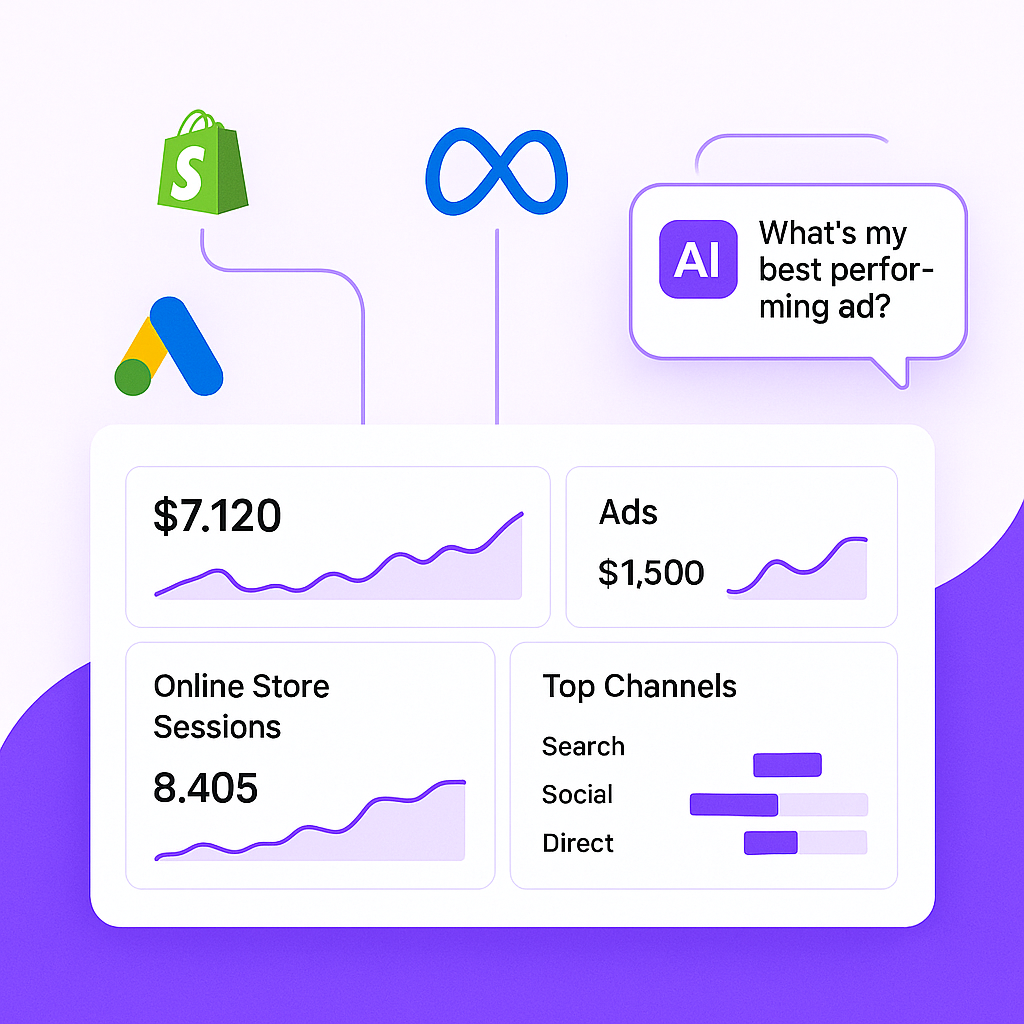

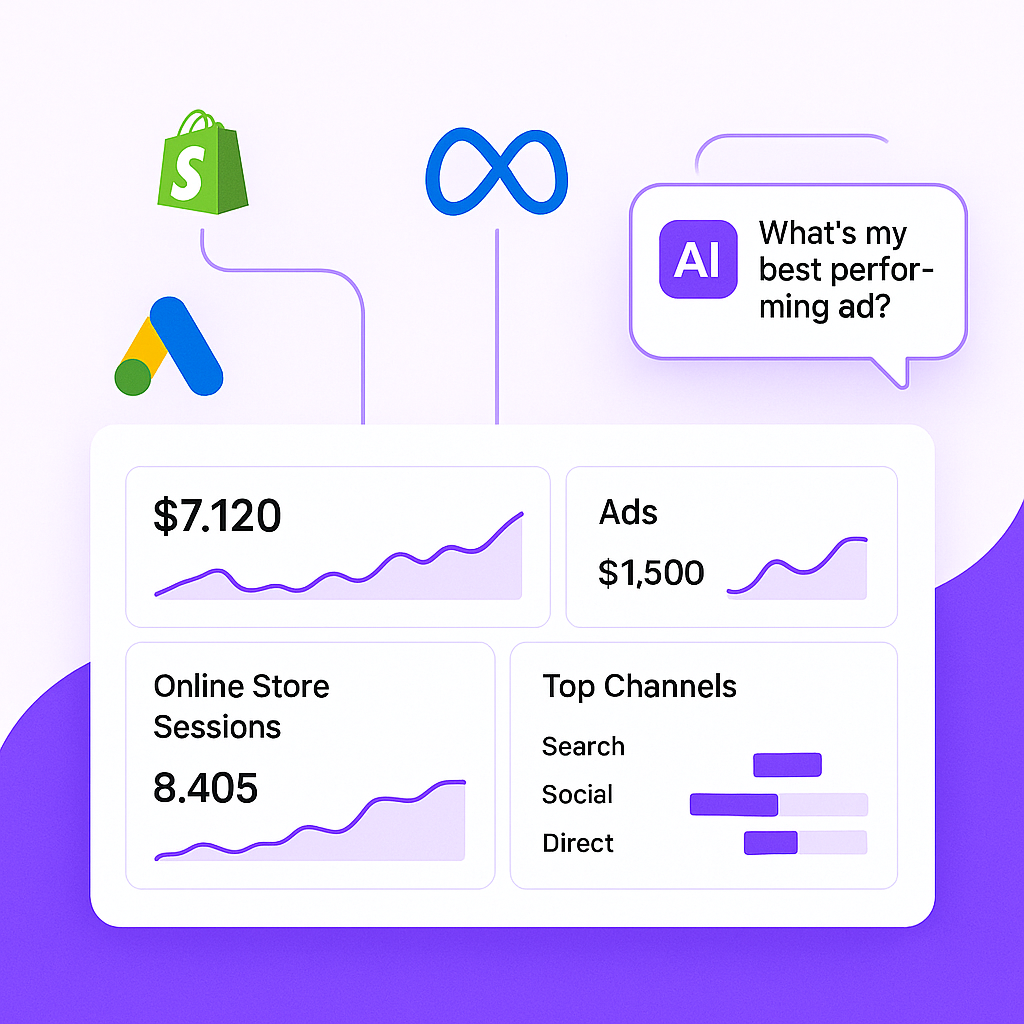

Unified Analytics for Modern Business

Integrate Shopify, Google Ads, Google Analytics GA-4, and Meta in one powerful dashboard. Get comprehensive insights and make data-driven decisions.

Integrate Shopify, Google Ads, Google Analytics GA-4, and Meta in one powerful dashboard. Get comprehensive insights and make data-driven decisions.

Everything you need to track your business

Track your e-commerce performance with detailed Shopify analytics and insights.

Monitor your ad campaigns and ROI with comprehensive Google Ads metrics.

Leverage the power of GA-4 with advanced tracking and reporting capabilities.

Track your social media performance and audience engagement metrics.

Join thousands of businesses that trust AZlytics for their analytics needs.

Sign up for free